Creating a Demat account has become an essential step for anyone who wants to invest in the stock market or build a diversified mutual fund portfolio. With the shift toward digital investing, the process to create a Demat account is simple, paperless, and can be done from the comfort of your home. Understanding the process thoroughly ensures that your financial journey starts securely and without unnecessary delays.

Understanding What a Demat Account Is

A Demat account, short for “Dematerialized account,” is an online repository that holds your securities—such as shares, bonds, and mutual fund units—in electronic form. When you create a Demat account, you eliminate the need for physical share certificates, reducing the risk of loss, damage, or forgery. This electronic system not only secures your assets but also simplifies the process of trading, transferring, and monitoring investments.

A Demat account works much like a bank account. While your bank account holds cash, your Demat account stores financial securities. It acts as a bridge between your trading activity and your investment portfolio, ensuring seamless buying and selling experiences in the capital market.

Why You Should Create a Demat Account

There are several advantages to creating a Demat account beyond simply holding shares digitally. The first and most crucial benefit is convenience. All your investments—equity shares, government bonds, exchange-traded funds (ETFs), and mutual funds—can be tracked and managed in one place.

Another key reason to create a Demat account is transparency. You can view your transaction history and holdings anytime, helping you make better investment decisions. For individuals who are looking to build or expand their mutual fund portfolio, a Demat account provides an integrated way to manage diverse assets efficiently.

Moreover, electronic record-keeping ensures that your investments are secure and easily transferable. This saves time and eliminates the risks associated with physical paperwork.

Steps to Create a Demat Account

Creating a Demat account is a straightforward process. Here’s how you can complete it securely and quickly:

1. Choose a Depository Participant (DP)

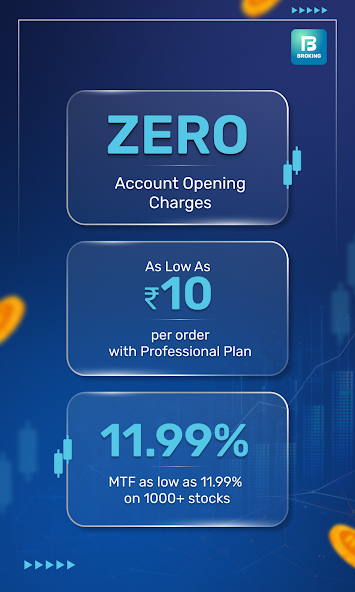

A depository participant acts as a link between you and the central depository. You need to select a DP registered with either of the major depositories in India. Compare account features, fees, and services before making a choice.

2. Fill Out the Application Form

You will be required to fill in your personal details, such as your name, address, contact information, and PAN number. Many platforms now provide online application forms for faster processing.

3. Complete KYC Verification

Know Your Customer (KYC) compliance is a mandatory step to verify your identity. Upload documents like a PAN card, proof of address, and a passport-size photograph. Online verification through video KYC has made this process faster and more convenient.

4. Sign the Agreement

You will need to digitally sign an agreement outlining the terms and conditions of your Demat account. It defines the responsibilities of both the investor and the depository participant.

5. Receive Your Demat Account Number

Once the verification is complete, your Demat account number or Beneficiary Owner ID (BO ID) will be generated. You can now link it with your trading account to start buying and selling securities.

Documents Required to Create a Demat Account

To create a Demat account smoothly, ensure you have the following documents ready:

- PAN card (mandatory)

- Proof of identity (Aadhaar card, voter ID, or passport)

- Proof of address (utility bill, bank statement, or rent agreement)

- Passport-size photograph

- Bank account details for linking transactions

Having these documents handy helps complete the process without delays.

Linking Your Demat Account to a Mutual Fund Portfolio

Once your Demat account is active, you can easily link it to your mutual fund portfolio. This integration allows you to view all your financial assets—stocks, bonds, and mutual funds—in one place. Monitoring your mutual fund portfolio through your Demat account provides better insights into your investment performance, helping you make data-driven decisions.

By linking your mutual fund portfolio, you can track redemptions, dividends, and NAV changes conveniently. This connection between your Demat account and investment portfolio ensures efficient management of your overall wealth.

Security Measures When You Create a Demat Account

Security is a top priority when handling financial information online. To create a Demat account securely, always ensure the following steps:

- Use only official and verified websites for account creation.

- Avoid sharing login credentials with anyone.

- Enable two-factor authentication for added protection.

- Regularly monitor your transaction statements for any unauthorized activity.

- Update your registered mobile number and email address for real-time alerts.

Taking these precautions ensures that your Demat account and mutual fund portfolio remain safe from unauthorized access.

Common Mistakes to Avoid While Creating a Demat Account

Many investors overlook small details that can cause delays or account issues. Avoid the following mistakes:

- Submitting incorrect or outdated documents.

- Not linking your bank account properly.

- Ignoring the account maintenance fees and charges.

- Sharing login credentials with third-party platforms.

By avoiding these errors, you can create a Demat account efficiently and maintain it securely.

Benefits of Managing Your Investments Through a Demat Account

A Demat account simplifies the entire investment process. You can buy, sell, or transfer securities without paperwork. It also ensures quicker settlement times and real-time portfolio tracking. Investors who maintain their mutual fund portfolio through a Demat account enjoy greater flexibility and better control over their investments.

Another key benefit is consolidation. Having all your holdings in one digital space helps you analyze your overall investment strategy and identify areas for diversification or rebalancing.

Conclusion

Creating a Demat account is a smart step for any investor who wants to participate in the stock market or manage a growing mutual fund portfolio effectively. By understanding the process and following secure practices, you can create a Demat account quickly and safely, ensuring a smooth start to your investment journey.

A well-managed Demat account not only protects your financial assets but also offers the convenience of monitoring all your investments in one place. Whether you’re new to investing or expanding your mutual fund portfolio, taking the time to create a Demat account securely will set the foundation for long-term financial success.