Entering the world of F&O Trading (Futures and Options) requires more than interest in the stock market. Unlike traditional equity investing, futures and options are derivative instruments where price movements demand close attention and calculated decisions. This form of trading is popular among individuals aiming for short- to medium-term opportunities, as well as those looking to hedge positions in a portfolio.

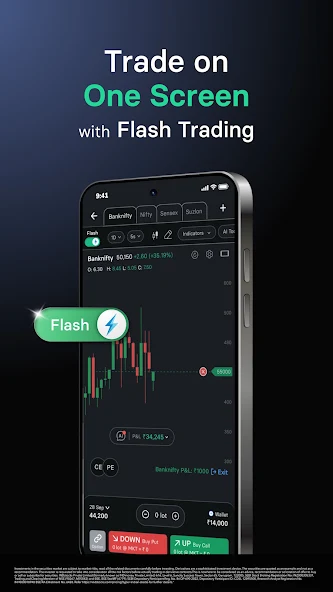

To succeed in F&O Trading, having the right tools and a clear understanding of the underlying contracts is essential. One of the first steps involves accessing an online trading app that offers real-time market data, seamless order placement, and accurate position tracking. When paired with structured learning and disciplined execution, this setup provides a strong foundation for traders starting their journey in the F&O Trading segment with confidence.

Understanding the Basics of F&O Trading

Futures and options are contracts that derive their value from an underlying asset, such as stocks, indices, or commodities. Both contracts are used in speculation and hedging, but their mechanics differ significantly.

Futures Contracts

A futures contract is an agreement to buy or sell an asset at a fixed price on a future date. These contracts are standardized and traded on exchanges. The buyer of a futures contract agrees to purchase the asset, while the seller agrees to deliver it at the contract’s expiry.

Options Contracts

An options contract gives the buyer the right, but not the obligation, to buy or sell the underlying asset at a predetermined price. Call options provide the right to buy, while put options provide the right to sell. The seller of the option, however, carries the obligation if the buyer exercises their right.

Both contract types involve margin requirements, mark-to-market settlements, and expiry schedules, which must be clearly understood before trading.

Opening a Demat and Trading Account

Before entering into F&O transactions, one must first open a Demat account along with a trading account. These accounts act as the gateway to buying and selling contracts through an online trading app.

Steps to Open an Account:

- Select a Registered Stockbroker

Choose a broker that offers F&O services with clear fee structures and robust trading platforms. - Complete the Application

Provide basic details such as identification, address proof, and income documents. Many platforms offer a paperless process through e-KYC. - Submit Income Proof

Since F&O involves leveraged products, proof of income is required to ensure trading capacity. This includes salary slips, tax returns, or bank statements. - Get Trading Access

Once documents are verified, F&O access is activated. From here, users can begin trading via the selected online trading app.

Choosing the Right Online Trading App

An efficient online trading app is vital to managing F&O positions. While choosing one, ensure it offers:

- Real-time price updates

- Advanced charting tools

- Option chain data

- Order types (market, limit, stop loss)

- Easy-to-navigate interface

- Portfolio tracking features

User-friendly apps that integrate these features can make it easier to evaluate contract prices, manage open positions, and respond to market changes.

Key Strategies for Beginners in F&O Trading

1. Start with Index Contracts

For new traders, index-based contracts (e.g., Nifty or sector indices) tend to be more stable than individual stock-based contracts. These allow users to understand broader trends and limit stock-specific volatility.

2. Focus on Limited Positions

Managing multiple open positions can be difficult for beginners. It is advisable to limit trades to one or two contracts until comfort with the mechanics of margin and settlements is established.

3. Use Options to Limit Risk

Options strategies such as protective puts or covered calls help manage risk while retaining upside potential. For instance, buying a put can protect a stock holding from price drops.

4. Avoid Trading Near Expiry

Volatility tends to increase near the contract expiry. Unless experienced, it’s better to avoid trading contracts that are close to expiration, as price swings and liquidity issues can increase risk.

Risk Factors in F&O Trading

Leverage Risk

F&O contracts allow traders to take large positions with limited capital. While this can amplify gains, it also increases potential losses. Misjudged trades can result in margin calls or forced exits.

Time Sensitivity

All F&O contracts come with a defined expiry. Unlike equity investments, time works against the contract holder. If the price movement does not occur within the time frame, the contract may expire worthless.

Market Volatility

Sudden changes in the market, especially in times of global or economic uncertainty, can impact contract prices sharply. Using stop losses and proper position sizing is essential.

Tracking and Managing Open Positions

Once trades are placed, active monitoring is required. The online trading app should allow quick position checks, profit/loss tracking, and order modifications. Margin availability must be checked frequently to avoid shortfalls, especially in volatile markets.

Daily mark-to-market (MTM) settlements are done for futures contracts, which reflect in the account balance. Failure to maintain sufficient funds can result in auto-squared positions.

Tips for Sustainable F&O Trading

- Begin with a demo or small capital

- Maintain a trading journal to log decisions

- Avoid decisions based on speculation or external opinions

- Use tools like option calculators and volatility charts

- Follow economic events and earnings calendars

Learning through experience is key, but education through reliable sources also builds long-term trading discipline.

Conclusion:

Starting with F&O Trading may appear complex at first, but with proper guidance, structure, and the right tools, it becomes manageable. A reliable online trading app plays an important role in offering a user-friendly interface, data tools, and fast execution for trading derivatives.

Begin your journey by focusing on understanding the mechanics of futures and options, starting small, and using calculated strategies that align with your risk profile. Whether you aim to hedge your portfolio or explore short-term price movements, F&O Trading can serve as a practical addition to your overall investment approach—provided you move forward with knowledge and discipline.